BLUF (Bottom Line Up Front): Retirement for Anesthesia Techs in 2026 is shifting away from traditional pensions toward 403(b) and 401(k) plans with mandatory auto-enrollment. With 2026 IRS contribution limits rising to **$24,500** ($32,500 for those 50+), the “reality” is that your retirement success depends almost entirely on maximizing employer matches and utilizing the new “Super Catch-Up” rules for those aged 60–63.

Introduction

For decades, a career in a hospital “Inn” meant a guaranteed pension. But as we enter 2026, the financial landscape for technical education professionals has changed. Today, “Retiring as an Anesthesia Tech” is less about a gold watch and a monthly check, and more about Innovation in Technical Education regarding your own personal finances.

Whether you work for a private surgical center (401k) or a non-profit hospital (403b), understanding the 2026 rules is the difference between an early exit and working “at the head of the bed” well into your 70s. This guide explores the ground-level realities of modern healthcare retirement.

The 401(k) vs. 403(b) Showdown

In 2026, most Anesthesia Techs are enrolled in either a 401(k) (for-profit) or a 403(b) (non-profit). Under the SECURE Act 2.0, most new plans now feature mandatory auto-enrollment, starting at a 3% contribution rate.

- Standard Limit: You can contribute up to $24,500 annually.

- The “Super Catch-Up”: A unique 2026 rule allows those aged 60 to 63 to contribute up to $11,250 in catch-up funds, totaling a massive $35,750 per year.

- Employer Match: Most hospitals offer a 3% to 5% match. Never leave this on the table. Leaving a match untouched is effectively taking a 5% pay cut.

The “Vanishing” Pension: Real Talk on Defined Benefits

If you work for a state-run university hospital or a long-standing unionized facility, you may still have a Defined Benefit Pension. However, these are becoming rare “relics” in the 2026 healthcare market.

- The Reality: Only about 15% of private-sector healthcare workers still have access to traditional pensions.

- Vesting Periods: Most hospital pensions require 5 to 10 years of service before you are “vested” (own the money). If you plan on becoming a “Travel Tech,” you will likely miss out on pension benefits entirely.

- The Trade-Off: While pensions offer a guaranteed check for life, they often lack the “inheritance” value of a 401(k). If you pass away, a pension often stops; a 401(k) goes to your heirs.

Social Security & Medicare: The 2026 Update

As an Anesthesia Tech, your retirement income will likely be a “three-legged stool”: Your personal savings, your employer plan, and Social Security.

- Social Security (2026): Benefits saw a 2.8% COLA increase this year. The average monthly payment for a retired worker is now approximately $2,071.

- Medicare Part B: Premiums have shifted to $185 per month.

- The Healthcare Gap: Even with Medicare, the average couple retiring in 2026 will need roughly $315,000 saved just to cover out-of-pocket medical expenses.

Retirement Advice from the OR

We analyzed recent “Retirement Realities” threads on Reddit’s r/anesthesiology and r/personalfinance to see what veteran techs are saying.

“I spent 20 years as a tech. My biggest regret wasn’t the pay—it was not switching to a Roth 403(b) sooner. Tax-free withdrawals in retirement are a game-changer when you’re on a fixed income.” — Verified Senior Tech, Reddit

“Don’t count on the hospital pension. Three of the hospitals I worked at ‘froze’ their plans. Build your own ‘Inn’ of savings so you aren’t dependent on their board of directors.” — AllNurses Community Member

The 5-Step Anesthesia Tech Retirement Roadmap

How do you ensure you can eventually hang up the scrubs? Follow this 2026-optimized path:

- Hit the Match: Contribute exactly enough to get the full employer match on Day 1.

- Max the HSA: If you have a High Deductible Health Plan, max out your Health Savings Account ($4,400 for individuals in 2026). It is triple-tax advantaged.

- The 1% Raise: Every time you get a merit raise, increase your retirement contribution by 1%. You won’t feel the difference in your take-home pay.

- Consolidate Old Plans: If you have 401(k)s sitting at three different hospitals, roll them into a single Roth IRA to reduce fees.

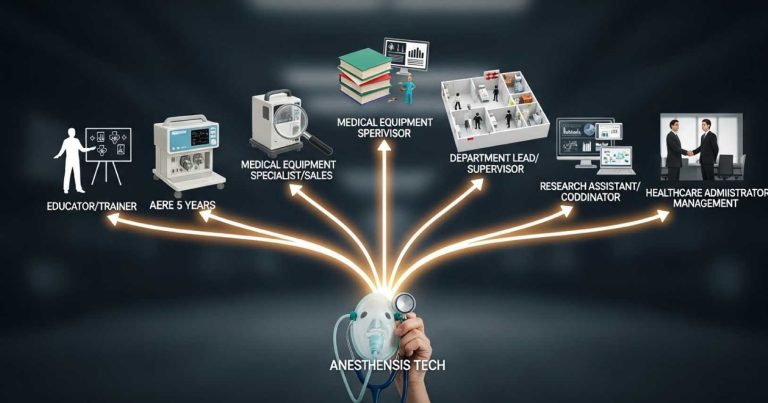

- Professional Growth: Use Innovation in Technical Education to become a Cer.A.T.T. (Technologist). The higher salary allows you to bridge the retirement gap faster.

Frequently Asked Questions

Q: Can I retire at 55 as an Anesthesia Tech? A: Yes, but you face the “Healthcare Gap.” You won’t be eligible for Medicare until 65, so you must budget for private insurance premiums, which can exceed $1,200/month for early retirees.

Q: What is a 457(b) and should I use it? A: Some government hospitals offer a 457(b) in addition to a 403(b). The major benefit is there is no 10% penalty for withdrawals if you leave the job before age 59.5, making it the best tool for early retirement.

Q: Is it better to have a Pension or a 401(k)? A: In 2026, most experts prefer the 401(k)/403(b) because it is portable. You can take your “Inn” with you whenever you change hospitals.

Secure Your Future Today

At TechEdInn, we believe that Innovation in Technical Education applies to your financial health as much as your clinical skills. Mastering the 2026 retirement rules ensures that when you’re ready to leave the OR, you’re doing so on your own terms.